A 188 Unit Multifamily Asset

Value- Add Investment Opportunity

ELEVATE STEWART'S MILL

Acquired in December 2023

16-18% AAR | >95% occupancy

A 188 Unit Multifamily Asset

Value- Add Investment Opportunity

ELEVATE STEWART'S MILL

16-18% AAR | >95% occupancy

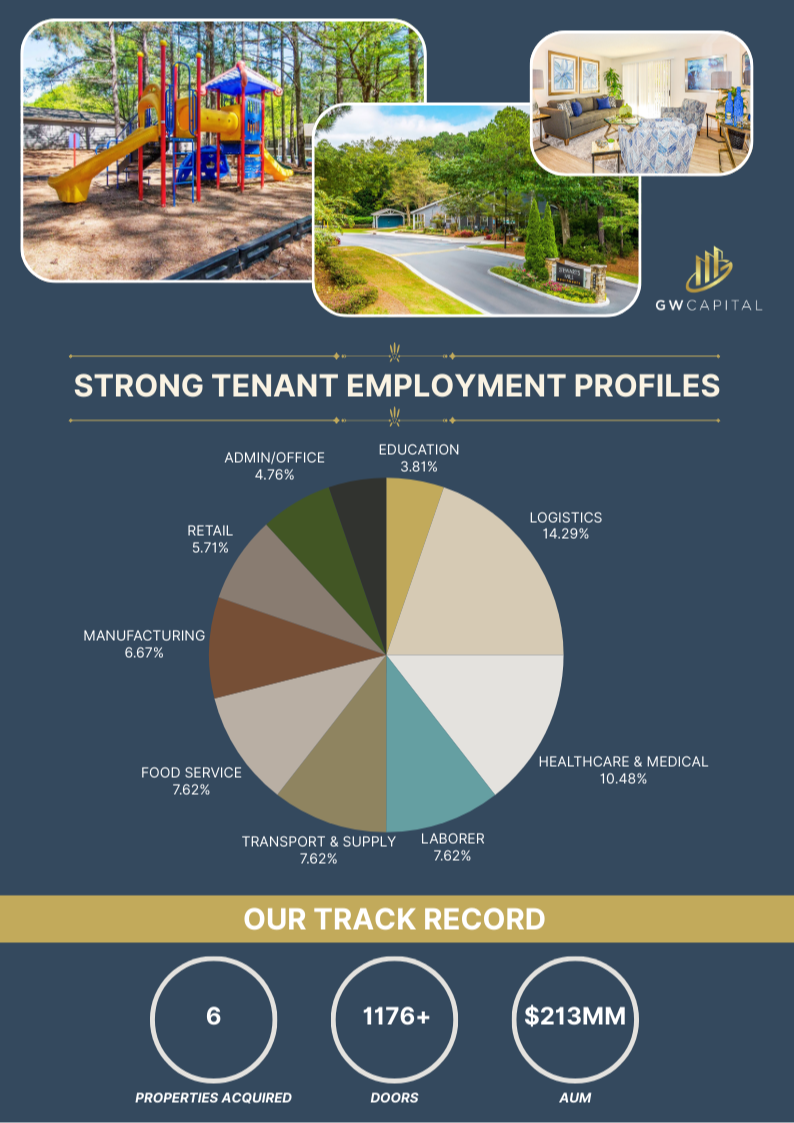

We are excited to announce our latest opportunity - another solid value add Multifamily investment opportunity in one of our favorite markets - right outside of Atlanta! Like always, our focus is on capital preservation and de-risking the deal - highlighted in the > 95% occupancy and conservative Fixed agency debt acquired.

WHY WE LOVE THIS DEAL?

Market Highlights:

- Elevate Stewart's Mill is a 188-unit value-add asset located right outside of Atlanta.

-

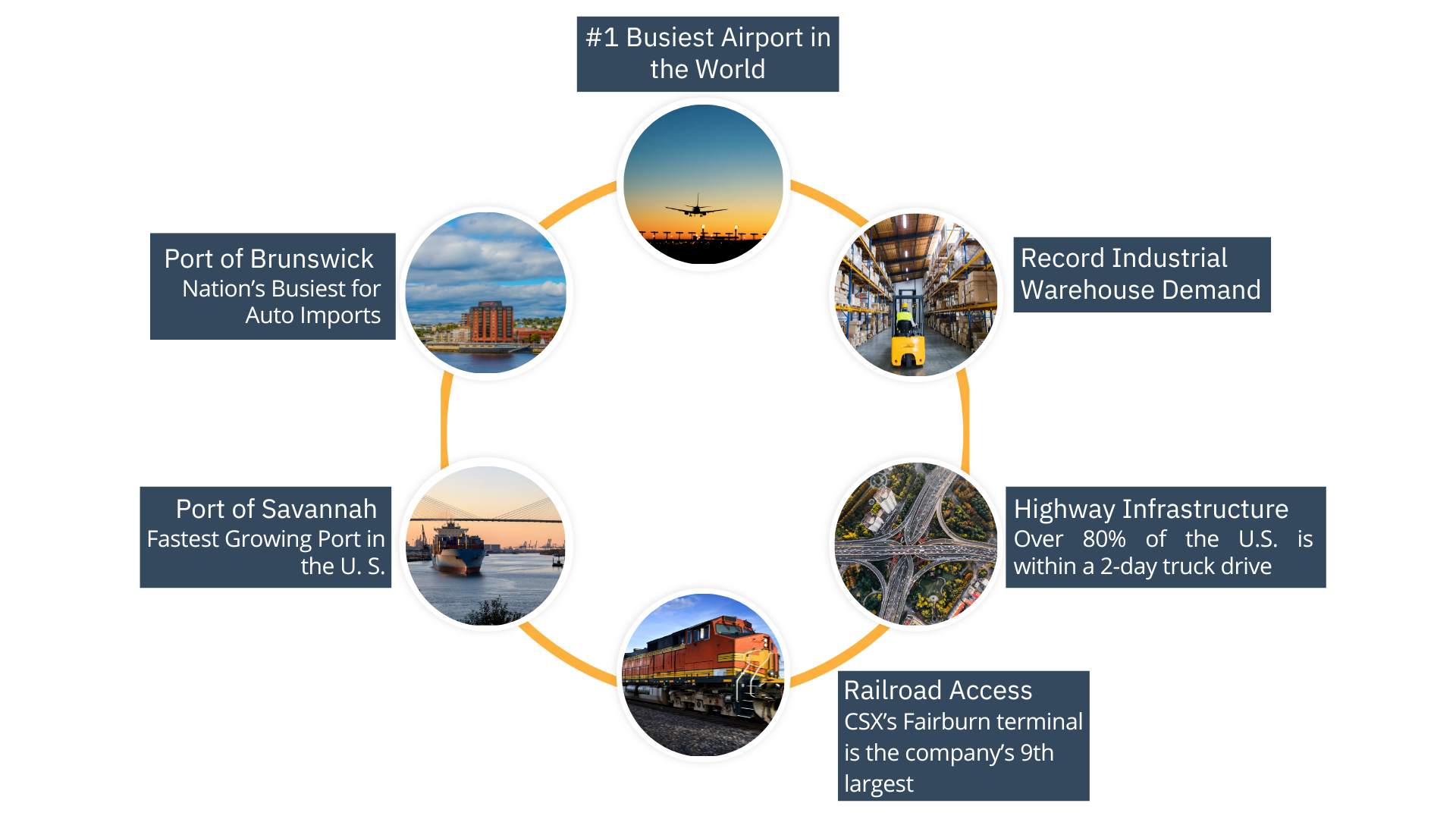

Elevate Stewart's Mill is conveniently located in the desirable I-20 West pocket, flush with strong economic drivers, and is less than one mile southwest of Arbor Place Mall, and just nine miles west of The Fulton Industrial Blvd.'s thriving industrial employment base. Stewart's Mill and the surrounding area benefit from excellent access to numerous and diverse employers nearby.

- GW Capital owns various properties in the Atlanta area, providing an operational economy of scale, including an opportunity to exit to an institutional investor at a high price.

Investment Highlights:

- This asset has tremendous value-add potential with a business plan of renovations on 73% of units.

- This, coupled with a stellar purchase price and significant discount of the market average has the potential to provide attractive returns to our investors.

- This property is already cash-flowing and has a 95% occupancy and 16-18% AAR making it a stable investment opportunity.

- Fixed Interest rate for 5 years at 5.75%, 2 years Interest Only

- Purchase price 17% below market Average

CATALYST FOR SOUTH ATLANTA'S GROWTH

*For Accredited Investors*

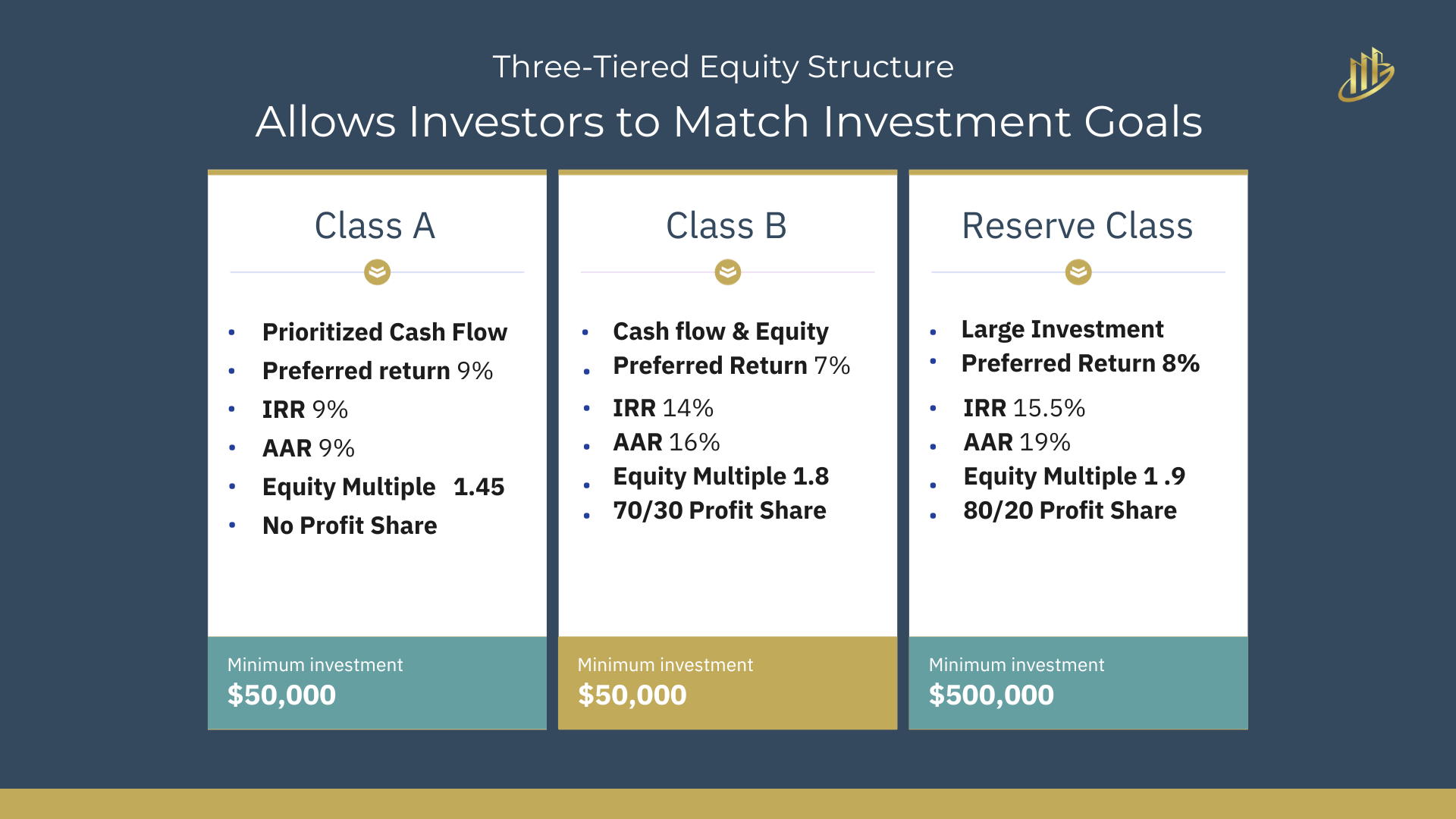

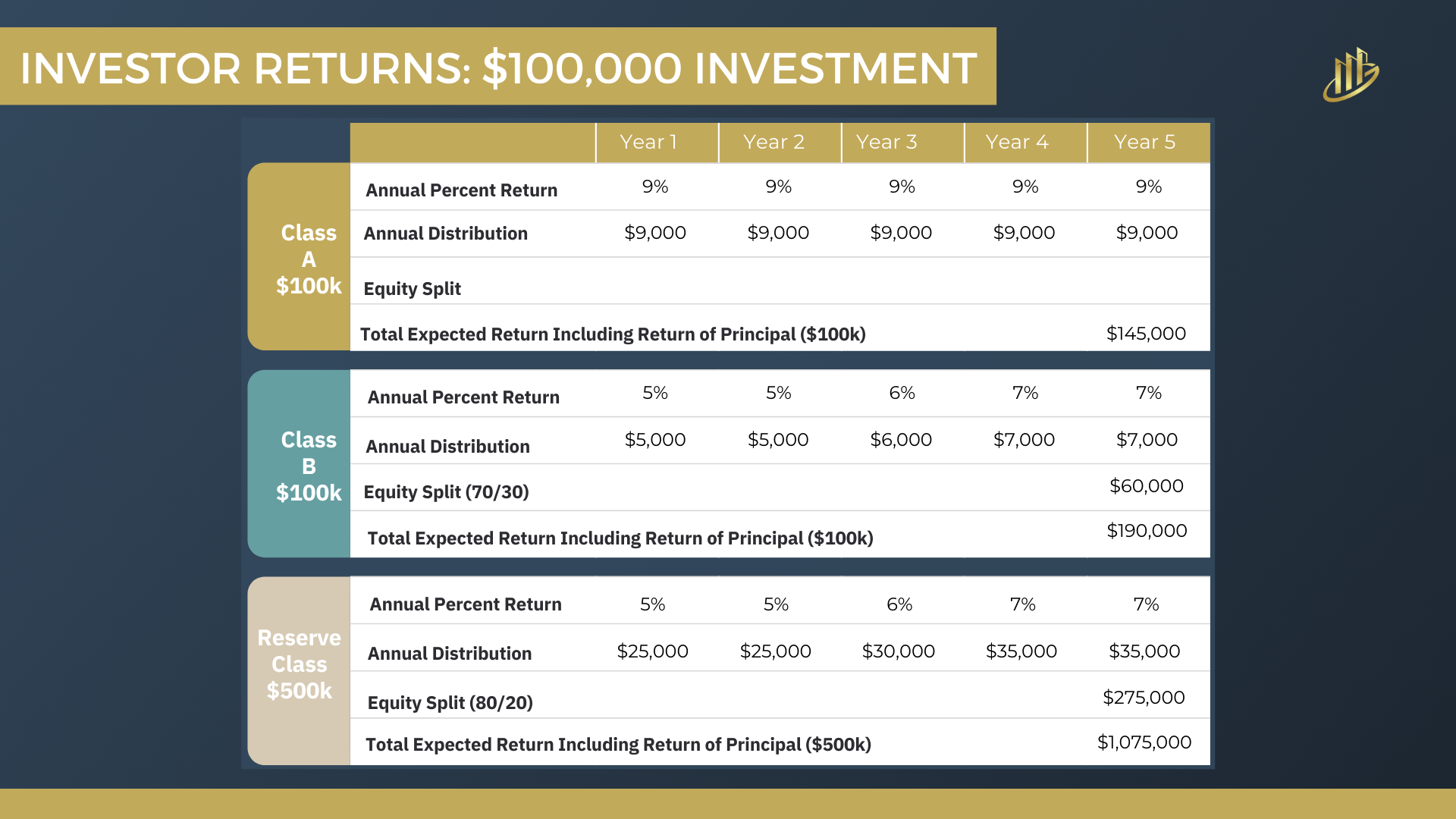

Three-Tiered Equity Structure

Allows Investors to Match Investment Goals

A three-tiered return structure gives investors options when placing their equity. Investors have the ability to invest in either tiers of equity Class A, Class B, Reserve Class or a combination of Class A and Class B. Diversifying in both A and B classes allows for a risk adjusted, blended returns.

DISTRIBUTION SPECIFICS:

In the event that cash on hand is generated from sale or refinance, this is the order of distribution:

- payment of all loans, unpaid Cumulative preferred returns to investors, return of all Capital Contribution (initial investment) to investors

- Only then will sponsor catch up be paid out (sponsor share of cash flow) This ensures higher investor cash flow upfront as opposed to having a true split of cash flow to sponsor

- Profit upon Sale is then split 70/30 for Class B and 80/20 for Class A till 15% IRR is reached after which additional profits are split 50/50

Elevate Stewart's Mill

Tour the Property

Elevate Stewart's Mill, Atlanta

Investment Summary

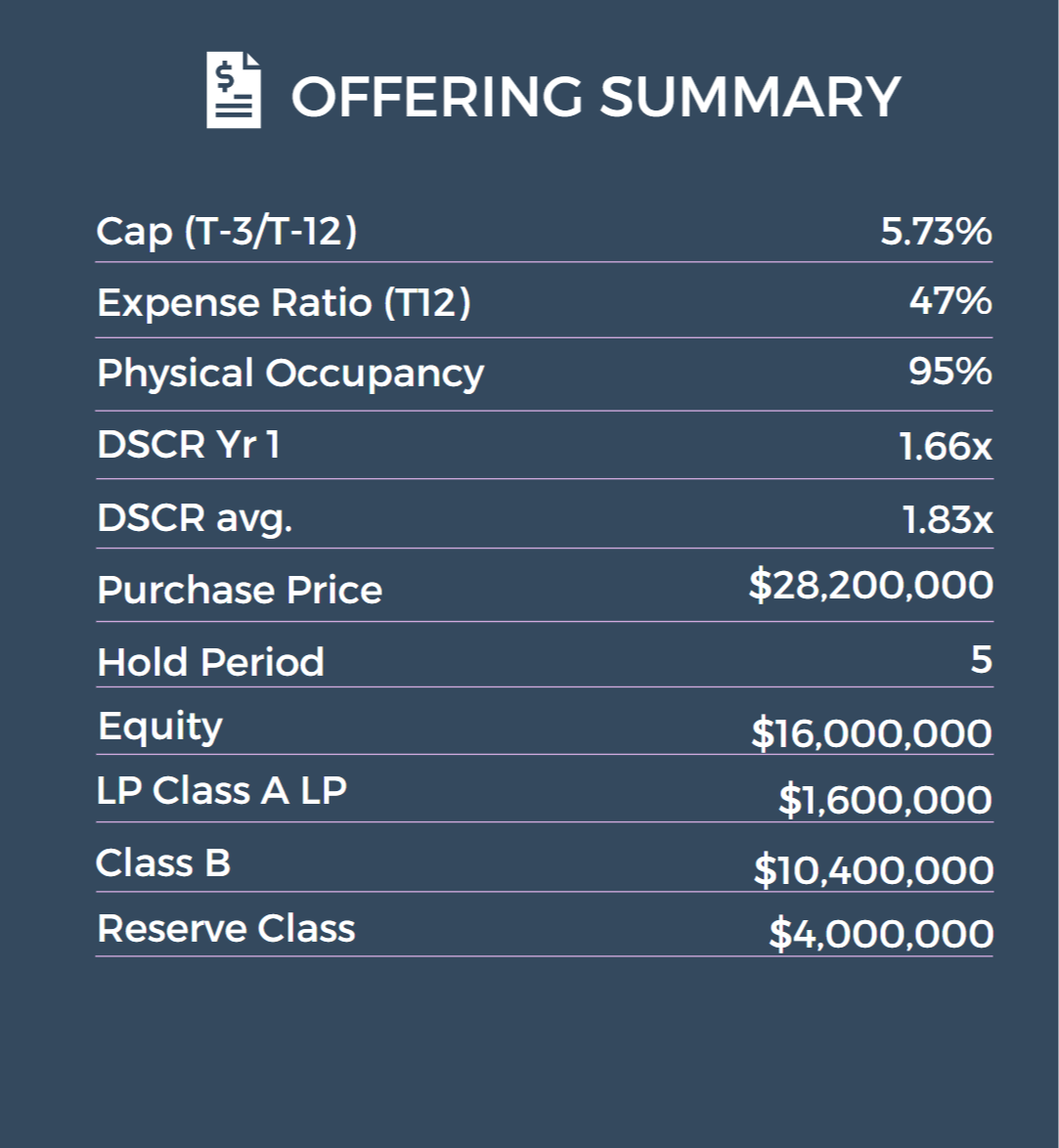

Introducing the 188-unit Stewart's Mill apartment community, located in Atlanta, Georgia. GW Capital is proud to present this exclusive listing situated in the coveted I-20 West area, with a wealth of robust economic drivers. The property is merely a mile away from Arbor Place Mall and nine miles west of The Fulton Industrial Blvd.'s thriving industrial employment base. Built in 1988, the Stewart's Mill development offers an exceptional chance to invest in a value-add asset achieving average premiums of $167 or more.

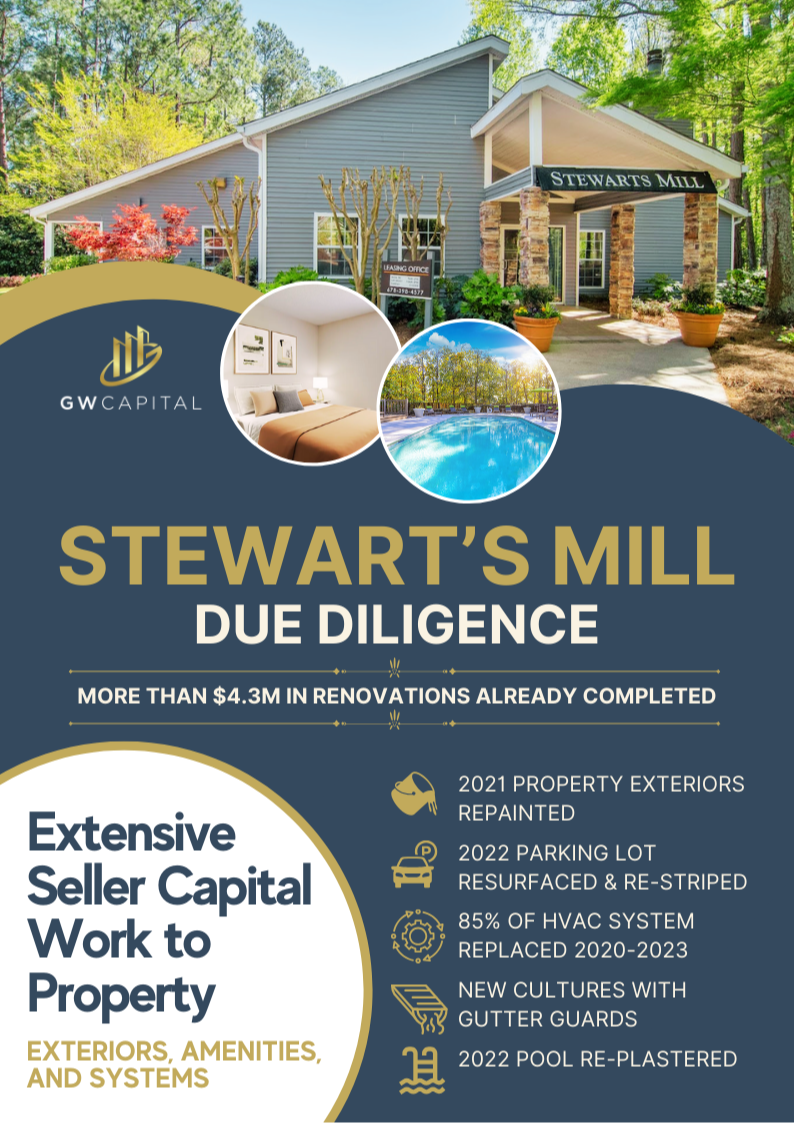

Stewart's Mill is an ideal choice for those who want to enjoy the peace and quiet of suburban living without sacrificing the conveniences of city life. The community boasts a variety of amenities, including a sparkling swimming pool, a fitness center, and a clubhouse. Residents can also take advantage of the on-site laundry facilities and detached garages available for rent. The apartments themselves feature spacious floor plans with modern appliances and updated finishes. With its prime location, exceptional value-add potential, and numerous amenities, Stewart's Mill is a fantastic investment opportunity that is sure to attract a wide range of tenants.

Elevate Stewart's Mill, Atlanta

- SOFT COMMIT - LOCK IN YOUR SPOT

* This is a Rule 506(c) offering for Accredited Investors Only

Timeline

Qualify for Money Market deadline - October 31.

Soft Commit deadline - November 5.

Funding deadline - November 25.

Expected Closing date - December 10.

*DEFINITION OF ACCREDITED INVESTOR (PLACE HOLDER)

You qualify as an Accredited Investor if you meet any of the following criteria:

a) You earn over $200,000 in annual income,

b) You, together with your spouse earn over $300,000 in joint annual income,

c) You have a net worth, exceeding $1,000,000 (excluding the value of primary residence) individually or together with spouse.

GOT QUESTIONS?

If you have any questions please feel free to message us at [email protected] or if would like to talk to us about how this asset would fit into your portfolio and goals, feel free to reach out to schedule a call:

Book a Call with Param