5 ways Real Estate investing blows investing in Index funds out of the water

Jun 04, 2021For those of you who know me, you know I am a hybrid investor. I invest in cash flowing rental real estate and in stocks/bonds. I like the liquidity and diversification that my stock portfolio provides. But I would say that I am a reluctant hybrid investor because I only really understood how superior real estate returns were much later in the game. Which is why in today’s post I want to focus on all the reasons Real Estate Investing is superior to Index funds, especially if you are a FIRE (Financially Independent Retire Early) enthusiast – and why you should give it serious consideration.

1. Returns in the growth phase :

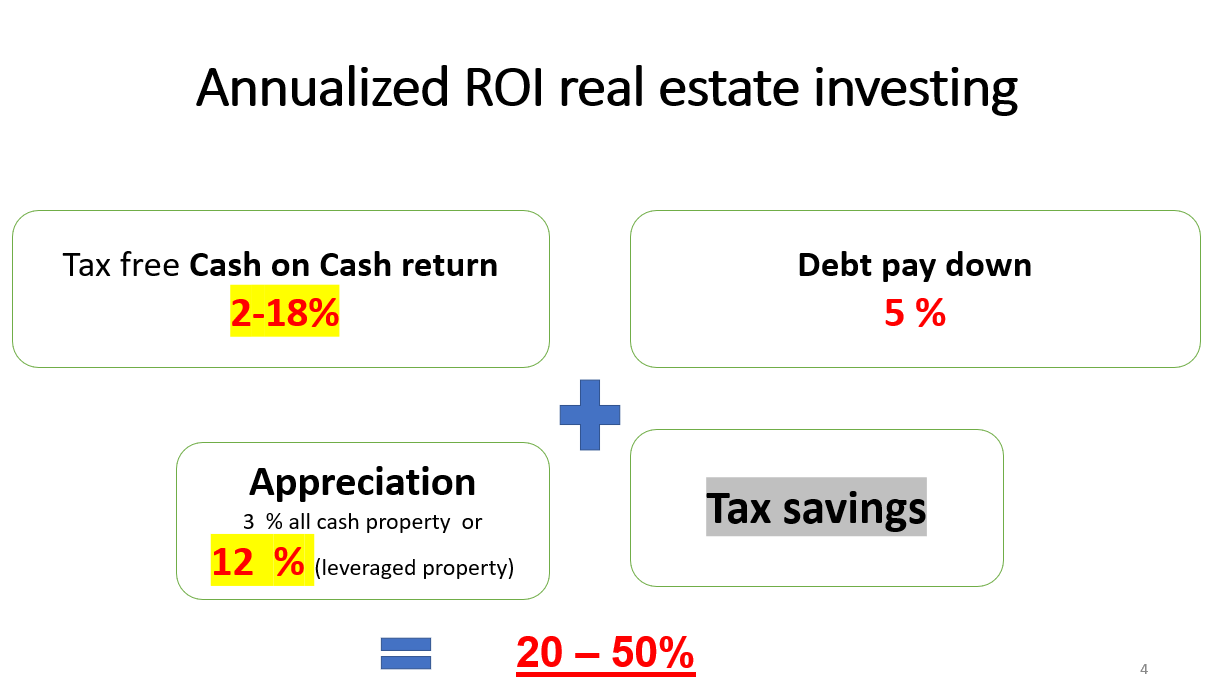

Historically, Index funds have around 10% annual ROI. Rental Real estate returns on the other hand as I discussed in this post, are multi pronged - once you factor in cash flow, equity build up from debt pay down and market appreciation (without factoring in tax savings or forced appreciation) - even the most conservative estimates for buy and hold properties are close to 20%.

What this translates to is the ability to reinvest your returns from real estate to scale more rapidly and reach Financial Independence faster. This is not something you can do with your stock portfolio.

2. Passive income in retirement and by extension - time to Financial Independence:

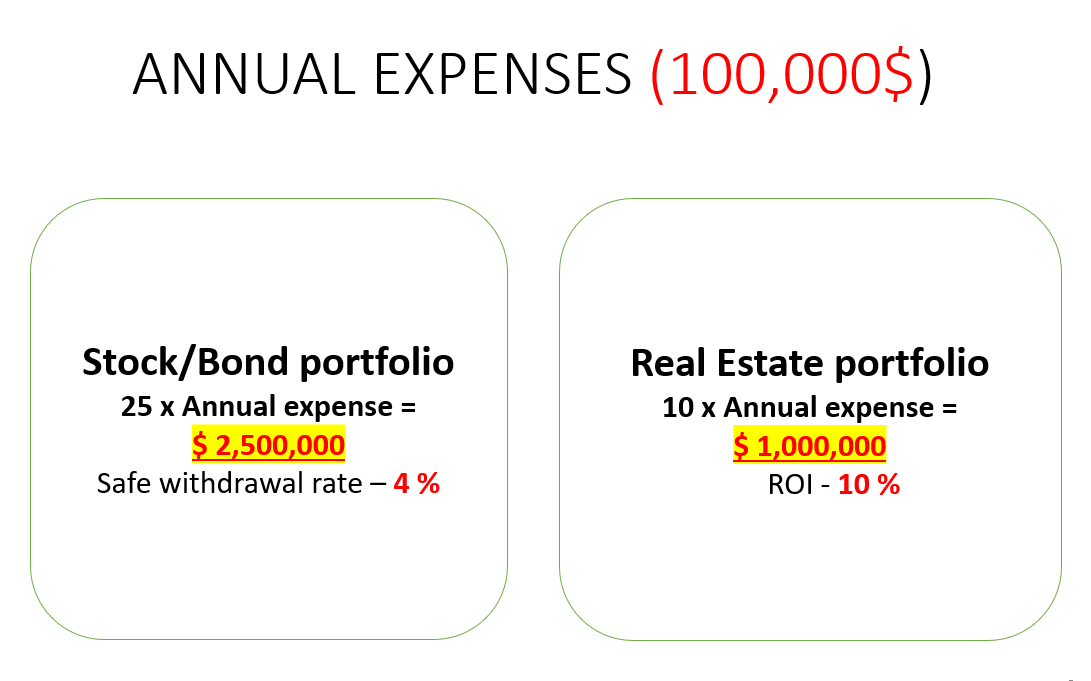

All the FIRE enthusiasts out there are probably aware of the safe withdrawal rate for your stock/ bond portfolio in retirement - 4% (check out this post for more details.) This is the withdrawal rate at which you can expect your portfolio to last you 30- 50 years in retirement. This factors in inflation and the fact that your allocation in retirement between stocks and bonds would be closer to 50:50 or 60:40. Which means if you need $100,000 of passive income in retirement from your stock/ bond portfolio - you need a nest egg of 2.5 million dollars.

With a pure real estate portfolio that generates 10% in Cash on Cash return (Annual Cash flow x 100/ Initial investment) - to have the same $100,000 in passive income, you need to have invested 1 million dollars in your portfolio. There are a few things to remember here- Cash on Cash return from your rental portfolio will increase over time because of :

- Increasing rents (3% national average annual rent increase which exceeds 2% annual increase in expenses - property taxes, capital expenditures and maintenance)

- Forcing appreciation and / or Cash out refinances which are strategies to tap into equity in the property which also increase your Cash on Cash return as you are left with less money in the deal.

So despite the fact that Index funds generate on average 10% ROI which may be similar to a 10% Cash on Cash return from your rental portfolio during the growth phase, your passive income in retirement is very different across these two asset classes. And we aren't even considering equity build up in your real estate portfolio here.

In essence you can hit your Financial Independence / Retirement goals much faster with real estate or you can generate much more in passive income with the same amount of money invested in real estate - however you prefer to look at it.

3. Net worth increase in retirement:

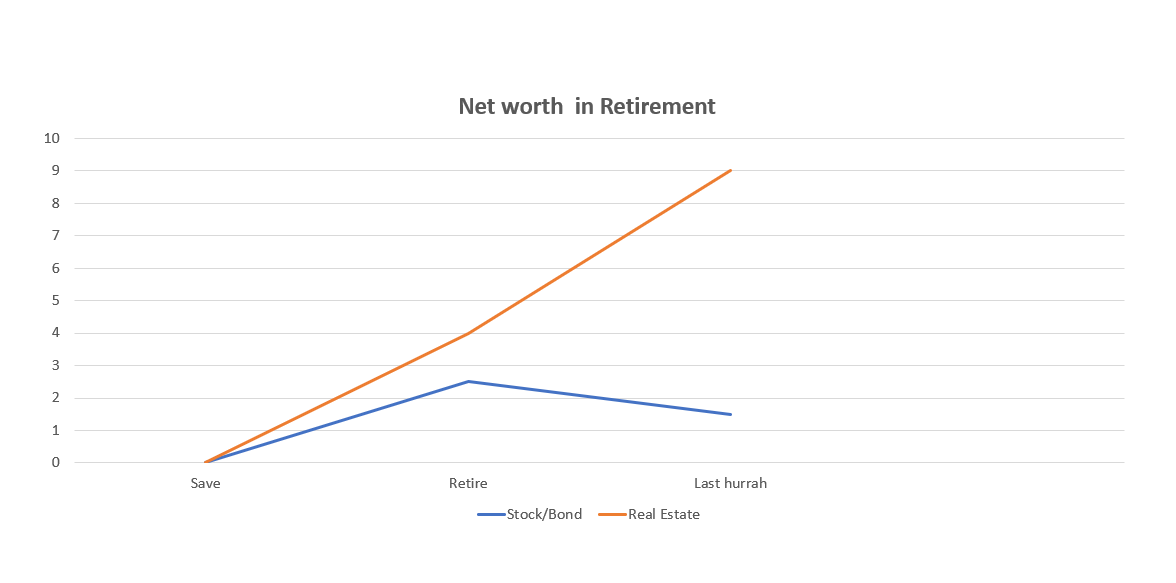

Below are two charts showing what the net worth of your portfolio would look like in retirement for a pure stock/bond portfolio vs a real estate portfolio.

The increase in net worth for your real estate portfolio would vary depending on whether you are leveraged or not, for the purpose of this example I am considering leveraged properties. Equity build up over time due to debt pay down and market appreciation continues in retirement.

With a Stock/bond portfolio - your net worth while drawing down assets would vary depending on whether you are in a bull or bear market.

4. Sequence of return risk

For those with a pure stock/bond portfolio, it is important to understand sequence of return risk during spending down assets and how it can seriously impact your retirement/ financial independence plan. This essentially means that if you have an early bear market right after your start drawing down your assets in retirement, you may not have enough of a buffer and may end up depleting your assets much quicker than you anticipated. It is imperative to have contingencies in place to protect against this scenario.

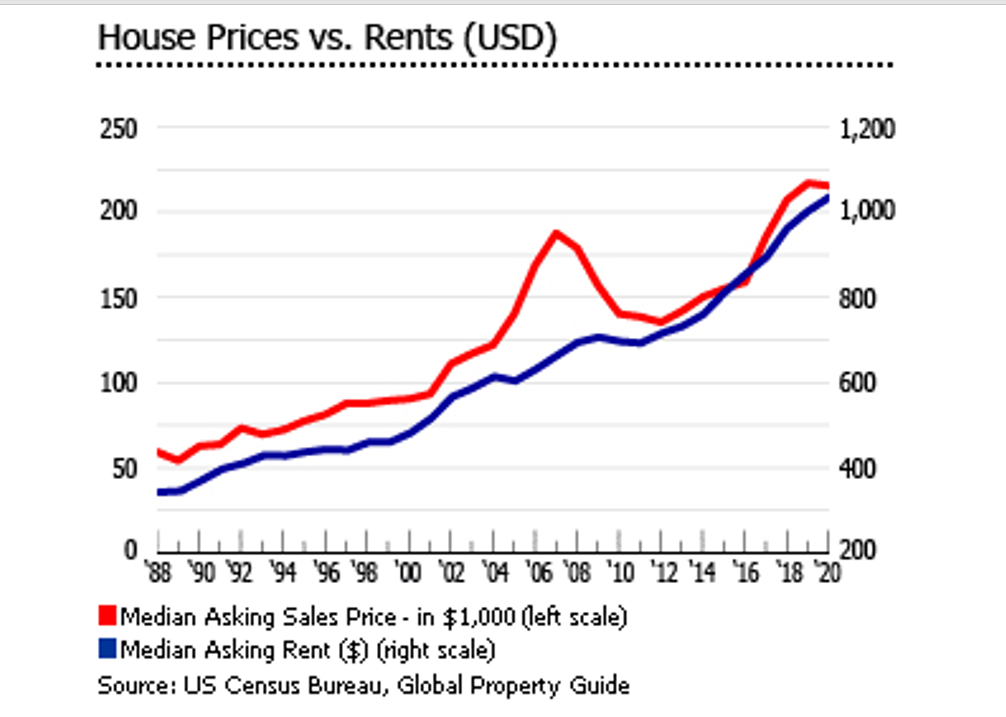

Real estate returns in retirement on the other hand do not involve a draw down. You have cash flow from your rentals that are inflation controlled, tax free and as described above, in most scenarios there is rent growth over time with increasing cash flow. I want to also highlight a graph of how average national rents have fared during real estate market crashes, just to show that although there may be huge drops in home prices with a market crash, rents tend to dip just slightly or not at all, protecting the buy and hold real estate investor.

5. Tax savings

This could be a whole post in itself, which I will get to soon. But to give you a brief overview:

- Cash flow from rental real estate is tax free due to depreciation. Dividends and withdrawals from your stock/bond portfolio are taxable- during growth and in retirement.

- 1031 exchanges and Cash out refinances are ways of tapping into built up equity in your real estate portfolio - both of which at the current time are non taxable events.

- If you are actively managing your real estate portfolio and meet criteria for Real estate Professional status (REPS) and Material Participation in your Long Term or Short term rentals (no REPS needed), you may be able to generate losses from accelerated depreciation in your rental portfolio that can shelter your clinical income from taxes.

At the end of the day, I think everyone should consider diversifying their retirement portfolios and include real estate holdings. If I had known what I know today 10 years ago, my retirement portfolio would look very different.

What shifts are you going to make to secure your financial future??

Looking for Resources to help you Start or Scale your Real estate portfolio so you can hit Financial Independence faster?

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.